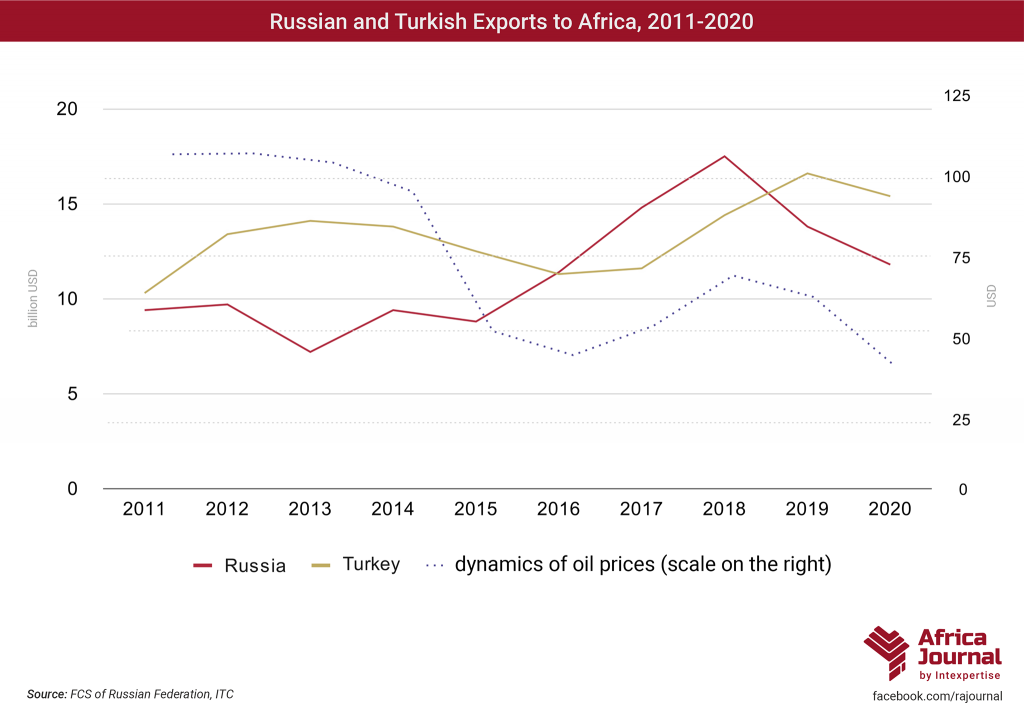

Russian exports to Africa have decreased for the second year running: in 2020 they amounted to $11.8 billion, reaching the 2016 level. In 2019, they were $13.8 billion, representing a sharp decline since $17.5 billion in 2018 and stopping the overall growth trend since 2015.

Most of the decrease is down to the trade with Algeria and Egypt. The supplies of Russian products to North Africa fell by $2.3 billion. This decline resulted mostly from the reduction of purchases of Russian military products by Egypt: in 2019 they amounted to $2.3 billion, in 2020 this figure was just $0.5 billion.

The overall volume of Russian exports to all parts of Africa depends heavily on military and petroleum products supplies: these two categories are 2nd and 3rd respectively among the largest export categories (cereals is the 1st). For that reason, changes to oil prices throughout the year have a strong effect on exports in terms of value.

Russia intends to increase the volumes of non-energy and non-commodity exports to Africa. In 2020, these amounted to approximately 85% of total exports. The diversification of trade is a key point in maintaining the balance and providing a solid foundation for the positive trend, while proving to be an effective shield in times of crisis or a drop in oil prices.

In comparison, Turkish exports to Africa have increased with a growth rate comparable to Russia-Africa exports since 2016, reaching $14.4 billion in 2018. It is also heavily dependent on trade with North Africa. However, as opposed to Russian exports, which have been in decline for two years in a row, Turkey has increased the volume of its supplies to Africa — in 2019 it was $16.6 billion and in 2020 just $1 billion less during the COVID-19 pandemic.